You might have heard the term small business a thousand times. But what does it really mean? Are you still small if you’ve hired 40 people? What about a solo consultant? Or a local agency with 12 staff?

The truth is, the answer depends on who you ask. To your neighbor, you might seem big. To the government, you’re still small.

Knowing where you stand can shape your access to funding, tax breaks, or even the right tools (like your CRM). In this guide, we’ll break down what 'small business' really means – on paper and in practice – so you know exactly where you fit.

What is considered a small business?

A small business is typically defined by its number of employees, annual revenue, and ownership structure. Depending on the country and industry, this can mean anything from a solo freelancer to a company with up to 500 employees or millions in revenue. These thresholds vary across governments and organizations, but they all focus on one thing: size and independence.

Everyday meaning vs. official definitions

Most people might describe a small business as a local company or an organization that’s just starting out. Think:

- A neighborhood bakery

- A boutique marketing agency

- A freelance web designer

These are businesses where the owner likely wears multiple hats and makes the key decisions. It feels small because it's close to home – familiar, approachable, human.

But when you dig into official definitions, things get more structured.

- Cambridge Dictionary says a small business is 'a company that is privately owned, does not employ many people, and has a low volume of sales.'

- U.S. Department of Commerce highlights that it’s 'independently owned and operated, not dominant in its field, and aligned with Small Business Administration (SBA) criteria.'

- ASQ defines it as 'a privately owned corporation, partnership, or sole proprietorship with fewer employees and lower revenue than larger corporations.'

In short: feelings vs. frameworks. One is about how a business operates in its community. The other is about structure checkboxes: headcount, revenue, independence.

Why small business definitions aren’t universal (and why it matters)

As you can see, there’s no one-size-fits-all definition of a small business. Governments, banks, and even global organizations each use their own criteria, based on employee count, revenue, or industry.

But here’s why that matters:

- Funding programs may only apply if you meet a specific size standard.

- Tax breaks or regulatory exemptions often depend on how your business is classified.

- Tools and resources (like CRMs) may be built with certain business sizes in mind.

So, depending on which definition you’re looking at, you might qualify as 'small' for a grant but not for a loan, or vice versa.

The good news? Capsule CRM is built for the full spectrum of small businesses, from solo consultants to growing teams.

No matter which definition you fall under, Capsule’s flexible features adapt to your needs.

By the numbers: how small is small?

It’s not just about feeling like a small business – there are hard numbers behind the label. Depending on where you operate (and what you do), 'small' could mean 10 employees or 500, $2 million in revenue or $40 million. Let’s break down the size standards that different countries and industries use to decide who qualifies.

Number of employees

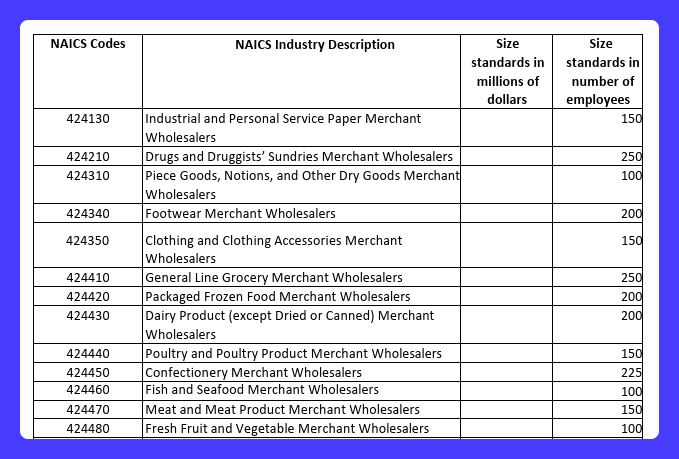

One of the most common ways to define a small business is by headcount. In the U.S., the Small Business Administration (SBA) uses employee numbers tied to specific industries, based on NAICS codes (North American Industry Classification System).

The limits depend on what you do, for example:

- Up to 500 employees for construction firms, logging companies, or sand and gravel miners.

- Up to 1,000 employees for industries like book publishing or wineries.

- Up to 250 employees for drug wholesalers.

Some sectors draw the line even lower. For instance, fish and seafood wholesalers are considered small if they have fewer than 100 employees.

These benchmarks are further summarized in the SBA’s Table of Small Business Size Standards:

So, while 500 is often the number tossed around, the real cutoff depends on your line of work.

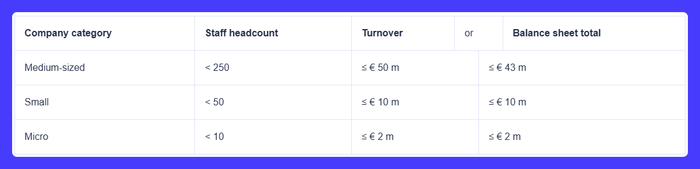

In the European Union, a small business is typically defined as having fewer than 50 employees, while micro-businesses have fewer than 10.

Annual revenue

Another way to define a small business is by annual revenue. The SBA in the U.S. sets different revenue limits depending on your industry. For example:

- A soybean farm qualifies as small if it earns less than $2.25 million annually.

- A cosmetics or beauty supply retailer can bring in up to $34 million and still be considered small.

- Florists? They cap at $9 million.Meanwhile, television broadcasting stations can earn up to $47 million and fall under the 'small business' category.

These numbers might feel large, but they reflect the realities of different industries. What’s considered small in retail or agriculture might be quite different from media or tech.

Ownership & control

Size isn’t just about headcount or revenue. Who owns and runs the business also plays a role. Most small businesses share a few key traits:

- They’re independently owned i.e not subsidiaries of a larger parent company.

- They operate for profit, offering goods or services to customers.

- They’re not dominant in their industry, meaning they don’t have outsized control or influence in their market.

In short, a small business is typically a standalone player, working independently to carve out its space without the backing (or baggage) of a corporate giant.

This helps explain why two companies with the same revenue could be classified differently — ownership matters.

Global perspective

Small doesn’t mean the same thing everywhere. While the U.S. often uses a 500-employee cutoff, other countries apply different standards based on headcount, revenue, or assets.

Here’s how some major regions define a small business:

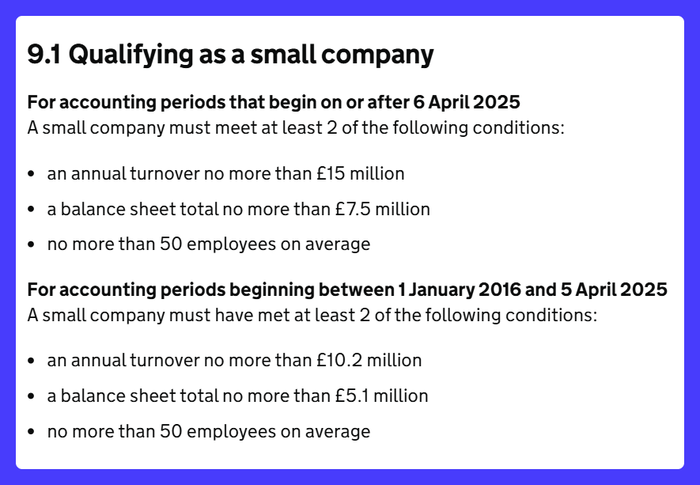

- United Kingdom: A business is considered small if it meets at least two of these: fewer than 50 employees, annual turnover under £10.2 million, or total assets under £5.1 million.

- Canada: Defined simply by size, between 1 and 99 paid employees across most sectors.

- European Union: Fewer than 50 employees and either a turnover or balance sheet total under €10 million, according to the European Commission.

- OECD (International): Typically 10–49 employees, though exact figures vary by country.

- Australia: Two definitions here. The Australian Taxation Office (ATO) focuses on turnover — under AUD $10 million. The Australian Bureau of Statistics (ABS) also looks at headcount, classifying small businesses as those with 5–19 employees.

- Singapore: Must meet at least two of these conditions: under S$10 million in revenue, under S$10 million in assets, and fewer than 50 employees.

There’s no single definition. Knowing how your region classifies your business helps you tap into the right resources and opportunities.

Why knowing your business size matters

It’s easy to brush off business size as a technicality. But knowing where you stand officially can open doors you didn’t realize were there. From funding to taxes to the tools you use every day, it pays to know how you're classified.

Access to funding and resources

A lot of funding is earmarked for small businesses. If you fit the criteria but don’t know it, you could miss out. In the EU, programs like the Single Market Programme and the Connecting Europe Facility offer support that’s meant just for businesses like yours—whether you're expanding, innovating, or exploring new markets.

Taxes and regulations

Tax perks aren’t just for big corporations. Small businesses can tap into credits and deductions, too, like the U.S. IRS offering up to $7,500 for electric vehicle purchases or a 20% income deduction for eligible small companies. The catch? You need to know you qualify.

Shaping your strategy

Once you know you’re small (in the best way), you can lean into it. Small businesses are flexible, fast, and personal in ways bigger firms can’t match. You don’t need layers of approval to get started. That’s a significant advantage over large businesses.

Small firm = big impact

If you’ve ever thought, ‘I’m too small to count,’ the answer is: you’re not.

Across the EU, small and medium-sized enterprises (SMEs) account for 99% of all businesses. That’s nearly every local shop, freelancer, builder, or agency you interact with daily.

In the U.S., small businesses employ 45.9% of the workforce and generate 43.5% of the country’s GDP. They drive jobs and spark innovation.

The takeaway? Being a small business doesn’t make you small in impact. You’re part of the engine that keeps the economy moving.

The small business juggle: how Capsule helps keep it together

Running a small business often means doing everything at once: chasing leads, answering emails, remembering which client needs a follow-up, and somehow staying on top of admin. It’s easy for things to get overlooked.

One day, it’s a missed callback. The next, an opportunity that slips away because no one remembered to send that proposal.

And when the customer count grows? Sticky notes just don’t cut it anymore.

Capsule CRM takes the scramble out of managing customers and sales. Instead of juggling tools, or wondering 'Did I follow up on that?', you get a single place that keeps track of:

- Who your customers are and where each deal stands

- What tasks need attention today (and which can wait)

- Every conversation, email, or note—so you always know the backstory

Capsule doesn’t overload you with features you’ll never use. It gives you just enough to feel on top of things without feeling overwhelmed. Simple, flexible, and designed for small businesses that don’t have time to babysit software.

Being small is your edge, not your limit

Whether you’ve got five employees or fifty, your business plays a bigger role than you think. Small firms fuel local communities, create jobs, and build the kind of customer relationships big corporations can’t.

Understanding where you stand helps you use the right resources and choose tools built for businesses like yours.

Capsule CRM is designed to keep things simple: helping you stay organized and grow at your own pace.

Ready to make things easier? Start your free trial now and see how Capsule fits your small business.

Frequently Asked Questions

Most governments look at a mix of employee numbers, revenue, and sometimes legal structure. In general, a business with fewer than 50 employees (in the EU) or 500 employees (in the U.S.) qualifies as small. Revenue thresholds can vary by sector and location.

In the U.S., the Small Business Administration (SBA) sets industry-specific standards based on either employee count or average annual revenue. For most industries, having fewer than 500 employees qualifies, though revenue caps can range from a few million to over $40 million. These benchmarks help decide if you’re eligible for programs like SBA loans or government contracts.

Yes. In most cases, 100 employees falls comfortably within the small business category. Many small firms operate with much smaller teams, but unless you’re scaling into the hundreds or thousands, you’re still classified as small.

That depends on your industry and where you operate. For example, in the U.S., SBA revenue limits range widely – from $2.25 million for soybean farming to $47 million for television broadcasters. In the EU, small businesses typically have a turnover below €10 million.

![Business statistics every business owner should know [2026]](https://cdn.sanity.io/images/poftgen7/production/5619faf6a65f53406d3e554c11c9e894402d4397-5760x3240.jpg?rect=5,0,5751,3240&w=300&h=169&q=75&fit=max&auto=format)