Writing a business plan feels like a major milestone... and it is. But if you’ve just finished your business plan, it’s only half the battle. A solid business plan helps clarify your business idea and map out your marketing strategy. Still, plenty of new businesses with impressive plans never make it past the starting line.

Why? It’s not the lack of planning that brings most ventures down. It’s the failure to execute and turn all those projections, research, and bold goals into real-world action. If you want to move from “dream” to “done,” it’s time to focus on implementation. Today, we'll show you how it can be done.

Step 1: Test if your plan actually works

Now’s the moment to get your business idea out of your head and into the real world. Don’t wait for everything to be perfect. Launch a basic version of your offer: post a simple landing page, talk to a few potential customers, or sell a first batch to see who bites. The goal isn’t to polish the plan, but to see if real people actually want what you’re offering.

Resist the urge to endlessly tweak details. Instead, put your minimum viable product in front of your target audience and ask for honest feedback.

Will they pay? Are they excited – or indifferent?

The reactions you get now are far more valuable than another round of “what ifs.”

Why does this matter? Because pivoting late in the business cycle can cost 10 times more than early validation. When you skip early market testing, you risk spending months (and a chunk of your startup capital) on something nobody really needs. That’s a shortcut to landing among the high percentage of businesses that don’t survive their first years – see more about why businesses fail here.

Get out there. Gather the proof. Adjust only once you know what works in the wild.

How real founders validate their ideas:

If you think market testing is only for billion-dollar brands, think again. On Reddit and Glassdoor, you’ll find hundreds of new founders, just like you, asking for real-world feedback before launching.

Online communities are where real conversations (and validation) happen. In fact, KickoffLabs made nearly 40% of its first revenue just by answering questions on Quora.

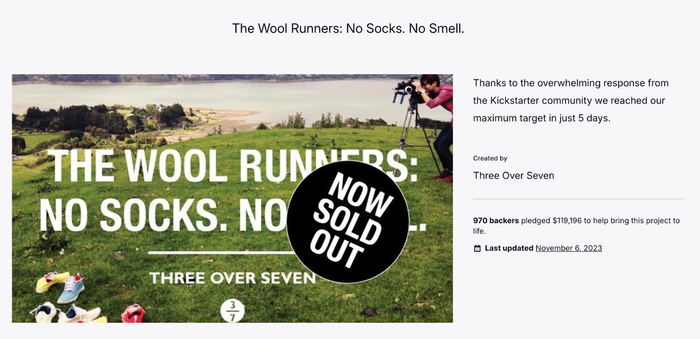

Or look at Allbirds, that raised its first $119,000 by going straight to Kickstarter. Their MVP wasn’t perfect, but it was real enough for people to back it and talk about it online.

And OpenBay’s founder went old-school, calling and messaging car owners and mechanics to get the truth about what people actually wanted, not what he thought they needed.

Don’t hide your business idea. Get it in front of real people, gather feedback, and see who bites.

Step 2: Handle the basics and make it official

Now that you’ve validated your idea and proven people are willing to pay, it’s time to sort out the official parts that make your business real. Your exact checklist will depend on where you’re based and what industry you’re in, but the fundamentals don’t change. Without ticking these boxes, you can’t collect payments, sign contracts, or even open your doors:

- Start by choosing a business structure, like sole proprietorship, limited liability company, or partnership, then register your business name with the relevant government agencies.

- Sort out your taxes and get the necessary paperwork in place.

- A business bank account is non-negotiable. Without one, you can’t keep your finances straight or get paid by clients and partners. Most financial institutions will want to see your registration documents and proof that you’re legitimate.

- Set yourself up for success by using smart tools from the start. Capsule CRM helps you track customer relationships and organize sales and marketing data. Use platforms like QuickBooks or Xero for business expenses, and Slack or Trello to manage communications and daily operations.

Getting these basics in order shows customers, banks, and even potential investors that you mean business. It’s your first step from “good idea” to a business others trust.

Step 3: Find your first customer, not your perfect product

Perfection is overrated – and it’s a recipe for procrastination. Now that your business is official, shift your focus from endless tweaking to getting your first real “yes.” Every successful business starts with someone willing to take a chance, even if the product isn’t perfect yet.

Start small. Use your business plan as a talking point: it tells you exactly who your target market is and why your offer matters.

Reach out to people via:

Personalized LinkedIn outreach

Message former colleagues, classmates, or industry contacts with a short note about your new business and who you’re helping.

Example: “Hi Dorothy, I just launched a virtual assistant service for small agencies. If you know anyone swamped with admin work, I’d love to chat.”

Slack or niche online community engagement

Join industry-specific Slack channels or forums and offer genuine help or a free mini-consultation.

Example: “Hey everyone, I’m building a content review tool for SaaS teams – happy to review a landing page for feedback as I work on my MVP.”

Direct questions

Walk into a neighborhood shop, coffee bar, or coworking space and introduce yourself. If it's a B2B company, do the same, but online.

Example: “I’m starting a new loyalty program for local stores – would you be open to a 10-minute chat about what actually gets your customers coming back?”

Be honest. Let others know you’re just getting started, but you’re focused on delivering real value.

If you hear silence or get lots of polite “maybes,” don’t panic. Instead, dig in. Ask for feedback, not favors. What’s missing? What would make them buy? How do they do that? Every “no” is an invitation to adjust your message, your offer, or even your business model. Sometimes, it means you need to revisit your value proposition.

Step 4: Grow your sales, from one customer to one hundred

You’ve validated your idea, landed your first “yes,” and learned what resonates with real customers. Now the goal shifts from getting started to building steady, scalable sales. Your market research and early customer feedback should already tell you where and how to focus. Here’s how to go from selling a single product to making your business a repeatable sales machine:

Double down on what worked

Your early sales aren’t random – they’re clues for your next steps as a small business owner.

Analyze your first wins: Did they come from targeted email marketing, a strong online presence, or a customer referral? Maybe a direct LinkedIn message landed your first deal, or a friend shared your offer with their network. Focus on these high-return channels and refine your approach using direct customer feedback and up-to-date market analysis.

What messaging attracted attention? Which platforms brought in actual buyers, not just visitors? Prioritize actions that align with your business goals and deliver measurable business growth.

Start building processes

Successful entrepreneurs don’t wing it – they systematize what works. As your business operations ramp up, set up basic processes to save time and free you to focus on growth.

Here are three things you should automate or standardize straight away:

- Sales communications. Create reusable templates for outreach emails, proposals, and follow-ups. This keeps your messaging sharp and your brand identity consistent.

- Customer tracking. Use a CRM like Capsule CRM to log every lead, deal, and customer outreach. With each entry, you’ll spot key performance indicators and identify which market trends are turning interest into sales.

- Feedback collection and review. Set up a simple system (a feedback form, automated survey, or regular check-in email) to gather valuable insights from every sale. This data informs your financial projections – and shows you where to raise your game.

Investing in processes early helps you prepare for significant changes, like securing funding from angel investors or operational partners, or scaling up for a successful launch. Don’t wait for things to get complicated; standardize your core steps now, and you’ll be ready for bigger opportunities tomorrow.

Ask for referrals and testimonials

Referrals are one of the most reliable ways to grow. Various studies show that referred customers are more likely to stay, and purchase rates climb when recommendations come from friends. Early adopters are your bridge to a wider audience. They’ve already said “yes” to your offer, so turn their goodwill into your next sales channel!

How? Make it easy for them. As shown in the Fellow example above, a simple referral program works: the customer shares a link, and both sides get a reward after a friend’s first purchase.

You can copy this approach without complex tech – use a unique discount code, a simple “forward this email,” or a handwritten thank-you note that invites them to mention you to someone who’d benefit.

Don’t stop at “spread the word.” After a sale, ask for a specific testimonial: “What surprised you most?” or “How did our product solve your problem?” Share these quotes on your website, emails, and social profiles. When a new lead is unsure, point them to honest feedback from real customers.

With every referral and testimonial, you multiply your credibility and reach. Over time, this snowballs – customers bring new customers, and your sales cycle gets shorter and warmer, not colder.

Step 5: Keep the money moving

Excessive optimism is a common trap. New founders often chase sales and exciting business goals, forgetting the reality of cash flow. More businesses run into trouble because they run out of cash, not because the idea wasn’t strong or the product wasn’t needed.

That's why you should:

- Track all money coming in and going out from day one. Use a spreadsheet, accounting app, or even a notebook – just be consistent.

- Check your business bank account balance regularly. It doesn’t have to be daily, but pick a routine (every Monday, for example) and stick to it.

- Keep your financial projections updated every month. Compare your forecasts with reality and tweak your plans when things shift.

- Don’t rely on a single invoice – plan for late payments. For example, have a buffer in your bank account or a backup plan for covering essential expenses if a payment is delayed.

- Limit spending to essentials; skip big purchases until income is steady. Focus on tools, supplies, or services that support day-to-day business operations.

- Ask customers for deposits or milestone payments whenever possible. It might feel awkward when you’re just starting out, but even a small upfront payment helps protect your cash flow.

- Review upcoming expenses and income at the start of each week. Knowing what’s ahead means fewer surprises and better decisions.

- Adjust your spending and sales tactics quickly if cash flow changes. Cut costs fast if needed, and look for ways to boost sales when you spot a dip.

And if you do hit a cash crunch, look into small business loans or government grants early. The sooner you act, the more options you’ll have.

Cash flow is your business’s lifeline. Protect it and adjust quickly when things change. That’s how successful entrepreneurs stay in business long enough to see real growth.

Step 6: Update your plan often

Business isn’t set-and-forget. What worked in month one might flop in month six. Successful entrepreneurs treat their business plan as a living document.

- Schedule a regular review. Once a month, set aside time to compare your actual results with your financial projections and business goals. It might feel predictable or even boring, but waiting until something breaks is far riskier. Spot issues early, and you can adjust before they become problems.

- Spot patterns, not just problems. Look beyond individual setbacks or wins – track what’s consistently working and what’s quietly draining your time or money. For example, if you notice that a few clients or campaigns bring in the bulk of your revenue, focus more energy there. If expenses keep creeping up in one area, dig in and cut back.

- Be ready to pivot, but don’t chase every trend. It’s easy to get lost in a sea of new tactics and advice, especially with so many tools and strategies out there. If a tactic falls flat over and over, drop it. When customers love something new, lean into it. Move quickly, but always check if each change fits your bigger mission and brand identity.

- Keep your big picture visible. Every time you update your marketing plan or adjust your business operations, ask yourself: “Does this get me closer to my core goals and business growth?” Avoid the distraction of shiny objects and stay true to the business you set out to build.

Learn from the data and use each update as a step closer to your goals. Sticking to a bad plan is worse than having no plan at all – keep yours flexible, and you’ll stay ahead.

The 80/15/5 formula for updating your business plan

- 80%: Stick with what’s consistently working. Keep 80% of your time, budget, and focus on proven channels, products, or tactics that deliver results.

- 15%: Experiment with improvements. Allocate 15% to testing new ideas, tactics, or markets – just enough to innovate without derailing your core business.

- 5%: Cut what isn’t working. Review performance honestly. If something repeatedly fails, cut it.

Formula:

Your updated plan = (80% what works) + (15% new tests) – (5% dead weight)

How to use it:

Each month, review your sales, expenses, and marketing channels.

- Double down on the 80% that drives your business.

- Use 15% of your resources to try new approaches.

- Drop the bottom 5%—the things that drain time, money, or energy.

Conclusion

Writing your business plan is just the beginning. Turning ideas into daily action is what separates real businesses from good intentions. Most entrepreneurs stumble because they freeze after planning – don’t be that story.

Need a practical way to move from planning to doing? Capsule CRM helps you turn your first contacts into loyal customers and keep your business data organized from day one. It’s a tool built for small business owners who want to stay on top of sales relationships, without getting buried in spreadsheets.

Try Capsule CRM and see how it can help you make better business planning decisions.