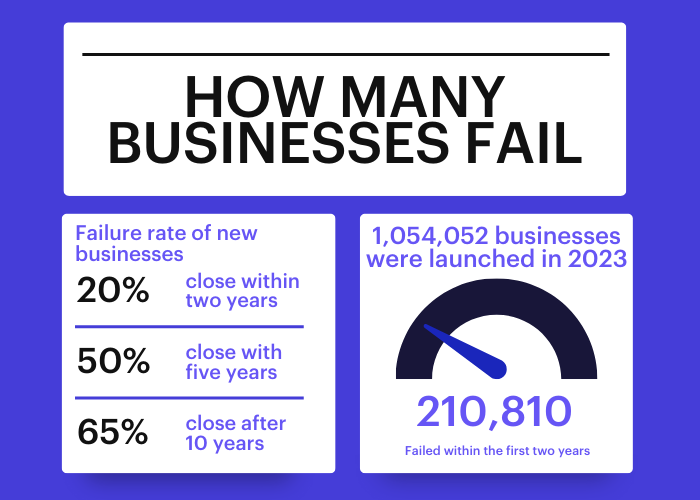

Starting a business is like planting a seed. You hope it'll grow into a big, strong tree, but not all seeds make it. 45% of businesses fail within the first 5 years and more than half don’t make it after 10.

It's tough out there in the business world, but why do so many fail? Is it bad luck, not enough money, or something else? Let's find out what makes some businesses thrive – while others wither away.

Top reasons why businesses fail

You’ve probably heard the phrase "half of startups fail" and the comment can seem off-putting for aspiring business owners. Fortunately, the vast majority of failed businesses share some common pitfalls, let's explore them in more detail.

Cash flow problems and running out of capital

Cash flow problems and running out of capital are critical issues. Surprisingly, despite 82% of businesses failing due to cash flow issues and 38% running out of cash entirely, some argue that other factors could be more crucial.

Businesses that start with insufficient funding or spend beyond their means are more likely to fail in the early years. Without enough money, companies struggle to cover essential costs and grow. Many new businesses take on too much credit card debt or fail to secure a proper business loan, leading to financial strain.

Business failure statistics show that poor financial management is a primary reason many businesses fail within the first five years.

So, cash flow can make or break a business.

It raises the question: Are businesses overly focused on cash flow at the expense of innovation or customer relationships? Understanding these dynamics and their connection is really important for business owners aiming for sustainable growth.

Strong competition

Cash flow problems are critical issues. However, strong competition is another major reason why businesses fail. About 20% of businesses fail because they cannot keep up with their competitors. Small businesses often struggle to compete against larger, more established companies.

The small business administration notes that the ability to stay competitive influences small business failure rates. Many businesses face significant startup costs, and they need the right team or strategy to stay caught up.

Business owners must understand the competitive landscape to achieve business success. Lack of competitive edge contributes to the high percentage of businesses that fail within the first few years. To avoid becoming part of these failure statistics, businesses need to continuously innovate and work on their USP.

Lack of market need for the product or service

It's tempting to open a business, but often founders set up a business first and find out whom they sell to and what their USP is second, while it should be the other way around. Lack of market need is a primary reason small businesses fail, with 35% of startups failing due to no market demand.

Business owners should understand their target audience and develop a unique selling proposition before they invest. Such oversight can lead to businesses closing and discourage would-be entrepreneurs.

Steve Ledgerwood - Capsule CEO

"The difference between a business that thrives and one that fails often comes down to adaptability and execution. Too many startups focus solely on their product without deeply understanding their customers or market.

The most successful businesses are those that continuously refine their strategy, manage cash flow wisely, and stay agile in the face of challenges. It’s not just about having a great idea, it’s about knowing how to navigate competition, pivot when necessary, and build lasting customer relationships."

Successful businesses focus on potential customers and industry data to ensure they meet a genuine need in the market.

And if it's not possible, they develop a minimum viable product (MVP) to validate their idea before putting a lot of dollars into it.

Poor business planning and market research

Neglecting to thoroughly research the market and develop a solid business plan is a major factor in why businesses fail.

Often, the excitement of having a business comes first, and research comes second.

Doing so might lead to poor decisions and the business idea never taking off. Many businesses fail because they simply don't check the business environment or understand their market need before launching their operations.

Poor location, online presence, and marketing

Businesses can suffer from growing pains if they're stuck in a bad location or haven't built a strong digital presence.

Imagine a storefront hidden in a back alley – customers won't stumble upon it easily. Similarly, a weak online presence means you're invisible in the vast digital marketplace.

This can make it tough to reach your target audience and address their needs, leaving your product or service a secret and your business missing out on valuable customers.

While launching a business is exciting, it's important to be aware of some common hurdles new ventures face. The good news is that these challenges are often interconnected, and by addressing them together, you can increase your chances of success.

We'll check the strategies for overcoming these hurdles later in the article.

How can small businesses protect themselves from falling?

Thrive in the right space

Ever feel like your business is shouting into a void? You've got a great product, but customers just aren't coming through the door (or clicking "buy").

It's not always about the product itself. Often, location (physical or digital) plays a huge role.

Sure, some businesses can thrive anywhere. But for many, choosing the right space is critical. A charming bakery tucked away on a quiet street might be a hidden gem for locals, but it would attract better foot traffic on a bustling avenue.

The same goes online.

A strong website and social media presence are your digital storefront. Without them, potential customers can't find you, no matter how amazing your products are.

Think of a local coffee shop. They might choose a location near a busy office park, offering quick breakfast options and convenient online ordering for busy professionals.

That's thriving in the right space!

Design your customer message

Think of it like this: if most businesses fail in the first year, wouldn't it be valuable to understand the primary reasons? It's not just about market conditions or economic downturns, although those can play a role. Often, it comes down to failing to connect with your target audience.

- Successful business ownership requires understanding your ideal customer. What are their needs, wants, and pain points? Speak directly to those in your message.

- Don't just tell people about your product or service. Explain how it solves their problems or improves their lives. People buy benefits, not features.

- Your message should be easy to understand. Avoid jargon and technical terms that might confuse your audience.

- Before investing heavily, test your concept with potential customers. Get feedback on how your product or service addresses their needs. Use surveys, focus groups, or even a simple landing page – whatever can bring you insights, fast.

- Let your brand personality shine through. People connect with genuine businesses, not robots.

That's how you lay the foundation for a thriving business. You attract loyal customers, differentiate yourself from competitors in other industries [oil and gas extraction companies might not face the same customer needs as a bakery, for example], and build a sustainable business model.

Manage money wisely

Even the best entrepreneurs with great business ideas can struggle if they don't manage their cash flow wisely. Cash flow is the lifeblood of any business, regardless of industry.

A steady cash flow allows you to reinvest in your business. This could be anything from paid advertising to attract customers (social media marketing, influencer marketing) to developing new products or services (online courses, digital products).

Let's state the obvious, too. You need cash to cover expenses like rent, payroll, and marketing costs. Without proper cash flow management, you risk falling behind on payments and damaging your reputation.

So, how can you manage your cash flow effectively? Here are a few tips:

- Track your income and expenses to understand where your money is going. This will help you identify areas where you can cut costs or increase revenue.

- Offer early payment discounts or implement stricter payment terms to encourage customers to pay on time.

- Set aside a cash reserve to cover unexpected expenses or slow periods.

Managing cash flow isn't about actually having a lot of money upfront. It's about being smart with your resources and planning for the future.

Stand out from competitors

Don't just blend in with the crowd – find your unique selling proposition (USP) and shout it from the rooftops. Start by thoroughly researching your competitors. What do they offer? How do they market themselves? Identify gaps in their offerings or services that you can fill with your own business.

Develop a strong brand identity that resonates with your target audience. This goes beyond just a logo – think about consistent voice and personality across all touchpoints.

Consider offering something unique that your competitors don't. It doesn't have to be a product – how many new businesses actually come up with extremely unique offerings? Exactly! You can differentiate yourself with exceptional customer service, a novel product feature, or an innovative business model.

A great example of this kind of rivalry is "the Cola wars". Coca-Cola and Pepsi have been competing for decades, not just with their soda products, but through their unique marketing campaigns and brand experiences. Pepsi introduced the Pepsi Challenge to directly engage customers, while Coca-Cola focused on its classic branding and customer loyalty programs.

Both companies innovate and adapt their strategies to stand out, but also watch their competitor's steps. Similarly, your business can thrive by finding that unique edge and consistently delivering value that sets you apart from the competition. Even if you're smaller than Pepsi or Coke.

Sometimes, a bold campaign can greatly increase brand awareness and attract new customers.

Remember, standing out isn't about being the loudest – it's about being the most relevant and valuable to your specific audience.

Take care of a customer feedback loop

Create a system to regularly collect and act on customer feedback. Involve post-purchase surveys, follow-up emails, or even in-person conversations for local businesses. Set up an automated email sequence that asks for feedback a few days after a purchase.

Analyze the feedback regularly, looking for patterns or recurring issues. Use this information to make concrete improvements to your products, services, or processes.

Close the loop by reaching out to customers who provided feedback, letting them know how you've addressed their concerns or implemented their suggestions.

Show that you value their input and can turn even negative experiences into positive ones.

Implement a referral program

Referrals can help your business growth because they are fairly easy to implement, don't cost much, and can be highly beneficial if done right.

You can use these strategies:

- Design a simple, attractive incentive for both the referrer and the new customer. This could be a discount, a free product, or an exclusive offer.

- Create clear, easy-to-understand terms for your referral program. Make sure it's easy for customers to participate and track their referrals.

- Promote your referral program through multiple channels – email, social media, in-store signage (for physical businesses), and on your website.

- Track the performance of your referral program. Monitor metrics like the number of referrals, conversion rate, and the lifetime value of referred customers. Use this data to refine and improve your program over time.

You need to make it beneficial for everyone involved – your business, the referrer, and the new customer.

Use efficient tools

There are awesome tech tools like design software and planners that can help your business run like a well-oiled machine.

But what happens when you're drowning in emails, customer info, and sales numbers?

That's where you're a step away from losing business.

And that's where a CRM system comes to the rescue. Think of it as a great address book for all your important client stuff. It keeps everything organized, helps you track potential customers, and even lets you see how sales are going on a daily basis.

With a CRM on your side, you can ditch the information overload and focus on what really matters – growing your business and steering clear of any bumps in the road.

We happen to know a great one. Capsule CRM can help you streamline your collaboration, optimize your contact management, and make the most of your sales workflow.

![Business statistics every business owner should know [2026]](https://cdn.sanity.io/images/poftgen7/production/5619faf6a65f53406d3e554c11c9e894402d4397-5760x3240.jpg?rect=5,0,5751,3240&w=300&h=169&q=75&fit=max&auto=format)