Sales takes planning. Both reps and managers invest time and effort into exploring the best way to utilize their dollars.

These plans are often presented in the form of a sales budget, a financial plan that estimates a company's total revenue in a specific time period. This document can help set realistic standards and clear goals for both sales teams and the wider organization.

In this guide, we’ll examine what a sales budget is, why they’re important and how you can create one of your own.

What is a sales budget

A sales budget is an itemized plan that forecasts a business’s total expected sales and revenue. It considers the number of predicted unit sales and your selling price and depicts how this will affect other business factors, like your annual budget.

They work as a reference point for how much money you expect to bring in over a specific time period. This gives businesses a goal to aim for and helps provide direction.

When both your sales reps and sales managers are aligned on their goals you can expect increased revenue and business success. (Which is always a good thing!)

How is it different from a sales forecast?

Although often confused, sales budgets and sales forecasts aren’t the same. While they share similarities there are a few key differences that you need to understand.

A sales budget is a static financial record that is typically produced once a year. It details:

- Estimates of total revenue and and gross sales

- Projects cash flow and debt reduction

- The steps taken to meet budget expectations (like adjusting employee pay).

A sales forecast is different, it outlines what a company or organization will sell and when. Sales forecasts are completed more frequently than sales budgets. They can be used to assess quarterly budgets meaning you can have a first quarter sales forecast and so on. This helps businesses with both short and long term planning.

Sales forecasts also:

- Forecasts a company’s expected financial growth over a specific period

- Limited to major revenue or expenses

- Not compared with actual results for variance analysis.

Why do businesses need a sales budget?

Sales budgets are growing. It’s been a tough few years for businesses. But despite the pandemic and continued economic uncertainty, budgets are rising. One 2022 study found that 73% of Chief Sales Officers reported increased sales budgets rose by 16.9%.

It seems that competition between businesses is just as heated as ever, so to stay ahead, you need to identify new growth opportunities.

Let’s examine the other benefits of a sales budget.

Set objectives

A sales budget is a financial plan that estimates a company's total revenue in a specific time period. But it can also be used to set clear targets that help senior leaders monitor both team and individual performance.

This 360 view provides valuable insight into any potential issues. With this level of clarity, you can solve problems before they become bigger issues.

Prepare for business lulls

Every business has lulls. Usually this is due to things outside of your control, like seasonal changes and holidays. If you can anticipate fluctuations you’ll be better prepared for them.

You could reallocate resources to mitigate serious issues.. For example, tackle any admin tasks that are usually left during busy periods, or increase cold calling or early prospecting activities.

Control and manage costs

Projecting how much you’ll need to spend on sales can help you avoid unnecessary expenses.

Sales budgets help other parts of your organization plan their next moves. For example, a business’s projected unit sales can be fed directly from the sales budget into the production budget. This helps companies determine their master budget and identify other important growth metrics.

What to consider when setting a sales budget

Previous sales data

Your company's historical data helps you recognize trends and market behavior. It can help you plan better budgets and show you when you should adjust your strategy. This could mean scaling down during slow periods or preparing for seasonal peaks.

Growth expectation

Exploring historic data allows businesses to spot trends and identify growth opportunities. Coupled with market research, and customer behavior changes, businesses can estimate their upcoming needs and plan for it. For instance if you need to expand or limit the number of products available in the coming year.

What should I include in my sales budget?

Regardless of the size of your organization, industry or what you sell, there are three key elements that you need to consider in a sales budget:

- Income statements

- Balance sheet

- Cash flow statements

Let’s look at each of these in more detail.

Income statement

Your income statement is the net income of your department. It’s a way of showing a general overview of your financial position. It lists expenses, gains, revenue and any business losses over a specific budgeting period.

It provides insight into your company’s efficiency. With an income statement you can identify where in your business you’re underperforming and which departments are more successful than others.

Balance sheet

A balance sheet details how much your organization is worth. It lists the assets, liabilities and equity that your company has, usually with a specified date.

This document can be prepared on a quarterly or monthly basis depending on local laws, sector and company policy. A sales team balance sheet offers insight into the health of your business and team.

Cash flow statement

A cash flow statement (CFS) summarizes how much cash - or cash equivalents move in and out of your sales team. It measures how you manage debt while funding other general operating expenses. Your cash flow statement can include:

- Interest payments

- Rent or mortgage payments

- Receipts from sales

- Employee wages

- Income tax payments.

How to build a sales budget

Set a time frame

The first step is to set a specific frame that your budget covers. This is known as your budget period. How long this time period spans is up to you and your business. You could choose to do things annually, quarterly or on a monthly basis.

In some instances you may choose to create a budget that covers smaller periods of time. This is useful when creating a budget for a specific seasonal period like Christmas.

Talk to your customers

Many businesses often skip this step but customer insight is invaluable. Client feedback can help you understand their needs and predict future spending behaviors.

For example, if your clients are repeatedly mentioning the same pain point, you can reallocate the sales budget accordingly.

Explore your competition

Most companies have to publicly share their revenue, which makes it easy for businesses to compare their sales performance. This can help you seek areas where your competitors are succeeding. This data helps you realign your strategies and focus on areas that need improvement.

Identify current market trends

Looking at current market trends can help you plan and make allowances for matters that may be outside of your control.

Shipping issues, increased fuel costs, lower sales figures and production issues can all impact your profit margin. Pre-empting potential issues can help you avoid future financial problems. That way you can devise solutions that limit business damage.

Look at historical sales data

Reviewing historical data is the best way to assess your sales expectations. It adds perspective to your sales budget and allows you to create a plan that’s accurate and efficient.

When you identify trends and patterns you can potentially measure future sales or new business. This can help you to manage your budget more efficiently.

Define your sales targets and set benchmarks

Once you have explored your previous data you’ll be able to better set objectives, key activities and expenses. Don't overlook communication during this time.

All parts of your business should be aware of your plan so that they can better keep track of changes within the organization

Monitor and adjust your plan

Make sure you continuously monitor and adjust your budget. If there’s a change in the market, or you’re failing to hit targets then you need to act quickly.

There’s no point sticking with a plan that isn’t getting results. So be ready to change tactics should the worst happen.

Sales budget best practices

It can be hard to know where to start when it comes to building a sales budget. But having one is the best way to stay on top of your sales operations.

Prepare for the unexpected

Unexpected expenses happen - that’s why it’s best to build a budget with a little wiggle room. Whether it’s inflation, economic uncertainty or anything else you can imagine a sudden cost can put a real spanner in the works.

Plan your objectives

Think carefully about what you want your sales team to accomplish, like a specific revenue or sign up goal. Identifying these can help you predict upcoming expenses and challenges.

Planning your objectives can help you anticipate what you will need to achieve these goals. You can also place benchmarks along the way that will help assess your progress.

Building a sales budget for 2024

Industries are constantly evolving and with 2024 on the horizon, you need to consider how your business will be impacted. Consumer preference and buying behaviors change year on year, so it's crucial that you're aware of potential trends and concerns.

Technological advancements like AI, are on every savvy business leader's mind. AI tools are helping to streamline a lot of practices but some organizations are concerned about what it will mean for their day-to-day lives. Digital disruptions can impact your sales channels leading to necessary budget adjustments, and with so much reliance on technology, it's important that businesses consider this carefully.

Regulatory changes can also affect your budget so you need to account for these uncertainties. Building a strong strategic alliance with your sales and legal teams can help you get to grips with potential changes, allowing you to plan ahead. Team alignment shouldn't just be tackled on a small scale. Sales and marketing teams also need cohesion to be successful in the upcoming financial year.

Increasing competition and market saturation is another concern and may require new innovative sales strategies and budget optimization. Many organizations are looking to data-driven decision making and predictive analytics to help improve their return on sales (ROS). So ensure that you look for other data forward solutions to streamline your process.

Sales budget examples

Now we’ve looked at what a sales budget is, and what you need to create your own, it’s time to look at some examples.

There are few templates to consider and the one you need will depend on the size of your business and your industry. So keep this in mind when exploring the templates below.

Monthly sales budget example

Monthly sales budgets are one of the most basic models compared to annual and quarterly budgets.

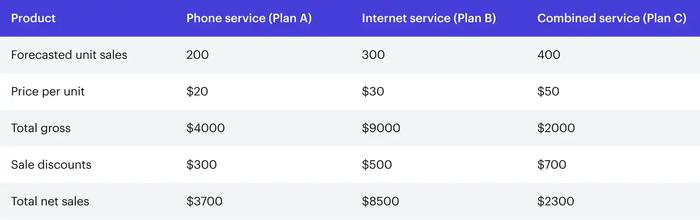

For example, a telecommunications company offers three plans. One with just phone service (Plan A), one with just internet service (Plan B) and a combined package that offers both (Plan C).

Annual sales budget example

An annual sales budget is much larger as it evaluates products over a much longer period of time. It evaluates each product individually for a more detailed view and allows you to look at sales on a quarterly basis.

Let’s look at how to build an annual budget using the same example. Below is an example of an annual budget for Plan C over the course of a year, starting in January.

With a full annual budget, you give each packet its own table so you can see how each product performs on its own. Trends will differ for each product a business so this allows you to keep track of customer records and preferences to create a successful sales budget.

Sales budget mistakes to avoid

#1 - Overestimating sales performance

A common mistake when creating a sales budget is overestimating future sales performance. This can lead to unrealistic sales targets and resources being wasted.

- For example, a company might base its budget on an optimistic view of market trends without considering potential downturns.

By not aligning the budget with realistic expectations, companies risk falling short of their sales goals, causing financial strain and operational inefficiencies.

#2 - Ignoring historical sales data

Not analyzing past data can result in inaccurate sales forecasting. Historical trends provide valuable insights into patterns that can help you make better decisions in the future.

- For instance, if a company ignores past seasonal dips in sales volumes, it may set overly ambitious targets for those periods.

Using a sales budget template and historical data creates a more reliable forecast and ensures better alignment with actual sales performance.

#3 - Lack of flexibility in the sales budget process

A rigid sales budget process can be detrimental, as it doesn’t allow for adjustments based on changing circumstances. Businesses should be prepared to adapt their budgets to market shifts or unexpected events.

- For example, a sudden economic downturn might mean you’ll need to revisit your sales budget.

Including flexibility in the budgeting process ensures that your company responds swiftly to maintain financial stability and meet its sales targets.

#4 - Misalignment with company expectations

When the sales budget doesn’t align with what the company expects, it can create confusion and mismanagement of resources. It’s important to ensure that any sales financial plan reflects company goals.

- For example, if your organization wants to expand into new markets, your sales budget should allocate funds for market research and entry strategies.

Proper alignment ensures coherent planning and resource distribution.

#5 - Overlooking detailed tracking and adjustments

Neglecting the importance of detailed tracking and periodic adjustments for your a sales budget can lead to discrepancies between projected and actual sales performance. Companies should regularly compare how they’re performing against the budget and adjust accordingly.

- For instance, using a smaller sales budget spreadsheet can help your frequently monitor and fine-tune performance.

This helps you maintain accuracy and relevance throughout the sales process, ensuring annual sales budgets are met.

Conclusion

Sales budgeting is a crucial aspect of business operations. They require careful consideration to get right and without one you could struggle to meet your goals.

Understanding the various elements that go into building a successful sales budget is imperative. That’s why it’s helpful to break the process down into simple, easy to manage steps

Sales teams have a lot on their plate - but by leveraging sales budgets, businesses can improve their overall performance and navigate the ever-changing landscape of the market. To stay on top of their goals, businesses need to utilize available technology.

Capsule CRM makes it easy to stay ahead when it comes to managing sales and leads - so your team can focus on the bigger picture. Try Capsule free for 14 days.

Frequently Asked Questions

A sales budget is a financial plan that estimates the expected sales revenue for a specific period. It's crucial for a sales team as it guides sales strategies, helps in setting sales targets, and assists in financial planning.

Historical sales data and market trends are vital in creating a realistic sales forecast. They provide insights into past performance and market dynamics, helping predict future sales more accurately.

Creating a sales budget involves analyzing past sales data, considering market trends, setting achievable sales goals, and estimating expected sales for the budget period.

A sales forecast predicts future sales based on various factors like market trends and sales strategies, while a sales budget allocates resources effectively based on these forecasts.

The sales department plays a crucial role in the budgeting process by providing sales data, insights into sales trends, and input on achievable sales goals and strategies.

A realistic sales budget ensures that the company sets achievable sales goals, allocates resources effectively, and avoids financial strain due to overestimation or underestimation of sales.

Sales teams can use sales forecasts to set monthly sales budgets by analyzing expected sales volumes and adjusting for factors like sales discounts, sales channels, and marketing strategies.

Calculating sales revenue in a sales budget typically involves analyzing past sales data, tracking actual sales, and considering factors like sales volume and total net sales.

Tracking actual sales and sales trends helps in creating an accurate sales budget by providing real data on sales performance, enabling adjustments to forecasts and strategies as needed.

Sales budgets are important for financial planning as they provide a framework for how the company expects to generate revenue, helping in making informed decisions about investments and expenses.