Many CRMs are not built for financial teams. They often lack the features advisors rely on most, like secure document handling, audit trails, and integration with planning tools. Instead of adopting a generic system, advisors need a CRM that supports long-term client relationships and regulatory needs out of the box.

Today, we look at the best CRMs for financial advisors, with their top features and considerations. We’ll also show you the most recent pricing for 2025, so you can choose a system that fits your workflow and budget.

The best CRM for financial advisors: our choices for 2025

We've researched the most popular CRM systems for financial advisors, and the results are below: the seven best choices for the financial services industry, with their pros, cons, and pricing.

Capsule CRM

Best for: Small advisory teams that need an easy-to-use, outcome-focused CRM

Capsule CRM offers an intuitive experience without sacrificing functionality. It helps manage client data, pipelines, and tasks without getting bogged down in complexity. It's ideal for teams that want a CRM that works out of the box and stays out of the way.

- Centralized contact records with custom fields for KYC, investment profiles, or client categories.

- Visual sales pipelines help track onboarding or deal stages with clear, drag-and-drop cards.

- Task automation allows for follow-ups, onboarding steps, or alerts based on client status.

- Email and calendar integrations keep all communication logged in one place.

Pricing: Starts at $18/user/month, and a free trial is available.

Considerations

Capsule doesn't come with built-in financial planning or compliance features, but with minor setup, it can be adjusted to specifically support financial advisors.

Workflow automation capabilities only come in the higher Capsule plans. Before purchasing Capsule, you can try the free plan or a free trial of the more advanced plans to determine what features you can(not) live without.

It is the best CRM for smaller advisory teams, but it also works really well if you run a larger firm with more complex processes.

Capsule gets high praise because of its ease of use and low cost.

Salesforce Financial Services Cloud

Best for: Large firms that need a fully customizable, enterprise-grade solution

Salesforce FSC is purpose-built for financial services and includes tools for household management, compliance, and advisor-client collaboration. It works well for multi-advisor firms with established workflows and the resources to manage a highly configurable platform.

- Unified client profiles aggregate financial accounts, life events, and relationship data.

- AI-driven prompts suggest next-best actions based on account history and firm goals.

- Custom workflows automate onboarding, compliance tasks, and approval processes.

- Extensive integrations with custodians, planning tools, and internal platforms.

Pricing: Starts at $300/user/month, and a free trial is available.

Considerations

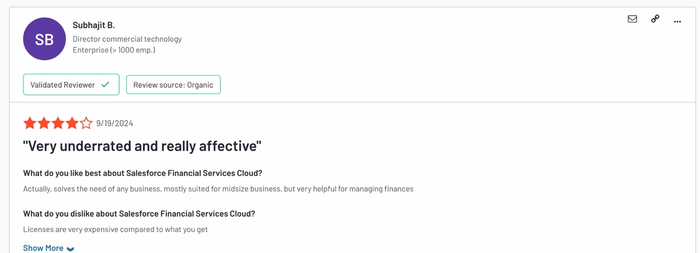

This version of Salesforce CRM is fairly expensive compared to the competition. It is a comprehensive solution, but the cost may be hard to justify for smaller teams that need only the basic features, such as contact management and mobile access.

After purchasing Salesforce Financial Services Cloud, you face hidden maintenance costs. You will likely need technical staff to maintain this CRM, too.

Ultimately, this is a CRM specifically designed for larger firms, and it may be too complex for solo financial advisors or smaller teams.

Salesforce is very expensive compared to almost every other CRM for financial advisors.

Wealthbox

Best for: Independent advisors who want a modern, easy-to-use CRM

Wealthbox is a CRM built for financial advisors, with a simple interface and industry-specific features. It balances ease of use with useful tools like workflows, client timelines, and integrations with the most common advisor tech.

- Timeline-based contact views show full client history and notes in a social-style feed.

- Automated workflows help standardize reviews, onboarding, and check-ins.

- Email sync and calendar integration keep communication aligned across tools.

- Integrates with planning, reporting, and custodial platforms.

Pricing: Starts at $59/user/month, and a free trial is available.

Considerations

Some core CRM features (such as email synchronization) are only available in higher-tier plans.

Wealthbox does not have a client portal and focuses mainly on the United States. It may not be an option for global financial advisors.

Perhaps worst of all, the customer support can be pretty disappointing.

Wealthbox has a number of negative reviews, many of them related to customer support issues.

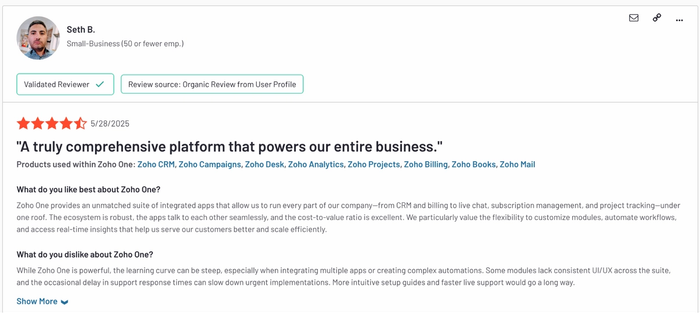

Zoho CRM

Best for: Budget-conscious firms primarily focusing on flexibility and customization

Zoho CRM isn't built for financial advisors out of the box, but it can be tailored to fit. It’s well-suited for firms that want to control their CRM layout, fields, and processes without paying a premium.

- Custom fields and modules for investment profiles, client segmentation, or workflows.

- Automation rules trigger follow-ups or onboarding steps based on client status.

- Multichannel tools include email, call logging, and webform lead capture.

- Ties in with Zoho’s suite for invoicing, email campaigns, and document handling.

Pricing: Zoho pricing starts at $14/user/month, and a free trial is available.

Considerations

Zoho can be very powerful, but setting it up for financial advisors may require some initial setup and customization. Zoho's dated interface can only make this more difficult.

Unlike other CRM tools on this list, it doesn't have integrations with other financial tools.

And like many other CRM systems, the best features are locked behind the more expensive tiers.

The more you want from Zoho, the more time you spend setting up the CRM.

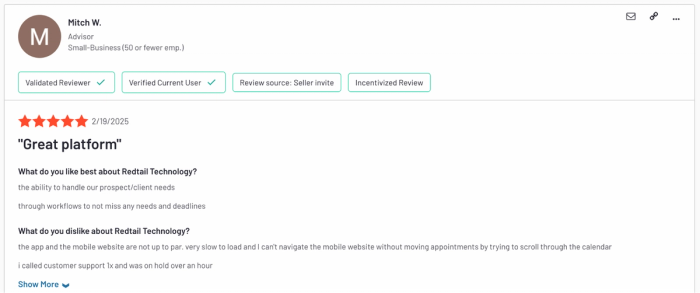

Redtail CRM

Best for: Advisors who want a proven CRM with compliance and advisor-focused tools

Redtail CRM is built for financial advisors and supports compliance needs, deep client records, and integrations with the broader wealth tech ecosystem. It’s trusted by many independent advisors and firms in the US.

- Prebuilt fields for client financials, beneficiaries, and family relationships.

- Compliant note-taking with time stamps and audit trails.

- Task management and workflows for onboarding, reviews, and outreach.

- Strong integration options with planning and custodial platforms.

Pricing: Starts at $39/user/month, and a free trial is available.

Considerations

Redtail feels very dated, so this is the wrong option if you're looking for something with modern UX an UI. This translates to the mobile app too, which comes with only the most basic features.

And like Zoho, you'll have to pay more to get anything beyond the basics.

If mobile accessibility is crucial for you, Redtail may not be a great fit.

AdvisorEngine (formerly known as Junxure)

Best for: Firms with complex workflows and internal processes

AdvisorEngine offers extensive workflow automation and task tracking for advisory firms with detailed service models. It’s powerful but takes time to configure and maintain, making it a better fit for established teams.

- Customizable workflows model every client service step with task assignments.

- Detailed client records include investment data, service history, and document storage.

- Advanced reporting for service activity, pipeline visibility, and advisor performance.

- Integrates with portfolio and planning tools through the AdvisorEngine ecosystem.

Pricing: Starts at $69/user/month, and a free trial is available.

Considerations

AdvisorEngine requires a minimum of three seats to start. This, coupled with the already high starting price, makes AdvisorEngine one of the most expensive options on this list.

Once you've made the purchase, set aside some time for learning, because AdvisorEngine will require training to use it effectively. The team can onboard you and migrate your data, but this too will take time.

Financial service users frequently complain about how difficult it can be to use AdvisorEngine.

Monday CRM

Best for: Firms that need flexible client tracking and project management in one tool

Monday CRM is not finance-specific, but it’s highly customizable and works well for firms with unique workflows. It blends CRM with project management, making it ideal for firms that want to track both clients and internal operations.

- Board-based views for pipelines, client onboarding, and internal projects.

- Task automation keeps teams on schedule with status updates and reminders.

- Collaboration tools include comments, tagging, and shared dashboards.

- Integrates with email, calendar, and common business tools.

Pricing: Monday CRM pricing starts at $14/user/month, and a free trial is available.

Considerations

Monday CRM ticks many boxes for business growth, but it was not built for financial advisors. You will need a custom setup to learn how to handle anything more complex than managing client information.

It's a cost effective solution at just $14 per month, but features such as automating tasks are locked in more expensive plans.

Purchasing guide: top features to look out for in a CRM for financial advisors

Customer relationship management tools come with numerous functionalities out of the box. However, financial advisors only need a handful of them to manage client relationships. Here is what the right CRM for your needs will have and how Capsule CRM can help you with each one.

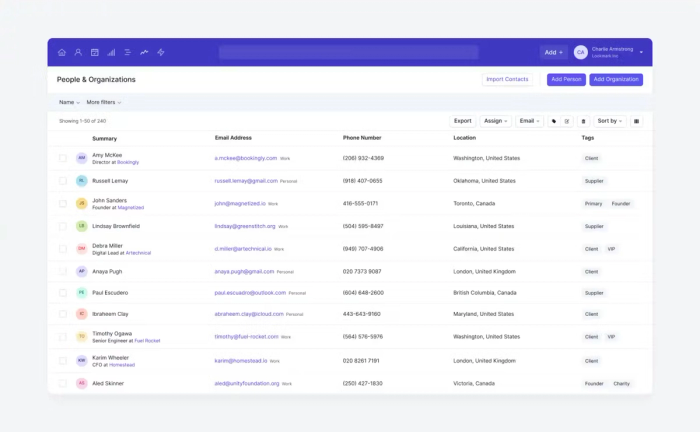

1. Client profile management

Financial advisors work with clients for years, so they need a reliable way to track personal and financial data. This includes risk tolerance, investment preferences, and life events like marriage or retirement. A well-organized profile helps advisors personalize recommendations and avoid mistakes.

CRM systems let advisors store detailed contact records with custom fields, notes, and history so they always have the full context during client interactions.

Capsule makes contact management easy, even for users who have never worked with a CRM.

Real-world example: An advisor managing a retired couple can quickly pull up their investment preferences, estate planning documents, and notes from a previous meeting to prepare for a portfolio rebalancing call.

2. Task and appointment tracking

Advisors juggle many time-sensitive responsibilities, from quarterly reviews to regulatory deadlines. Without a system, they can miss important follow-ups. A CRM for finance helps keep everything on schedule and visible across the team.

Capsule CRM includes task management and calendar integration so advisors can stay on top of follow-ups, meetings, and ongoing client work.

Real-world example: The CRM alerts the advisor that a 6-month review is due for a client. They schedule a portfolio check-in and prepare performance reports in advance.

3. Automated workflows

Onboarding and review processes require the same steps each time, and manual handling wastes time. Automations make these repeatable tasks more consistent and faster. They also reduce the chance of missing a step.

Capsule CRM’s workflows let advisors automate sequences of tasks for onboarding, annual reviews, or document requests.

Real-world example: When a new client signs an agreement, the CRM triggers a workflow to request KYC documents, assign onboarding tasks to support staff, and set reminders for initial planning sessions.

4. Document storage and management

Advisors need quick access to past financial plans, signed agreements, and tax returns. Searching through email or local files is inefficient and insecure. A CRM with document storage centralizes and protects this information.

Many CRMs integrate with Google Drive and Dropbox, making it easy to store and access important client files directly from the client record.

Real-world example: During a virtual call, an advisor opens the client’s folder in the CRM to review last year’s tax summary without having to switch systems or search email.

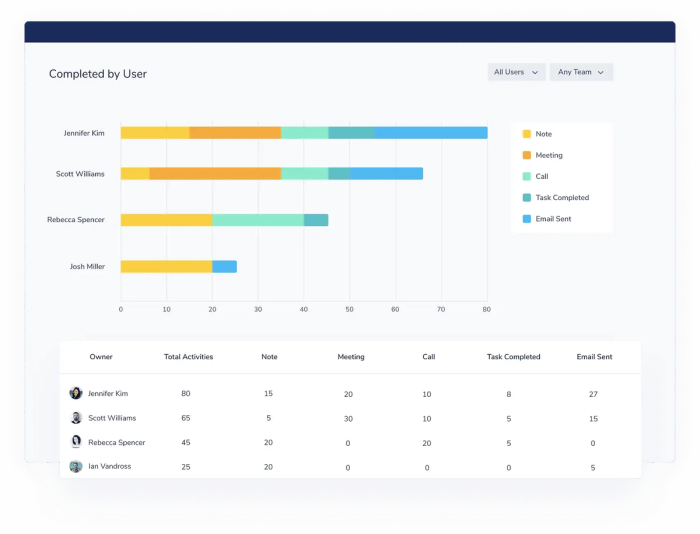

5. Customizable reporting

Clients expect reporting that reflects their specific goals, not generic statements that can apply to everyone. Advisors need to show performance in the context of retirement targets, risk levels, or cash flow plans. A good CRM should let them generate these reports without manual effort.

Most CRMs support custom fields and filtering so that advisors can build client lists and export reports based on financial metrics or service milestones.

An example of a report created in the free Capsule plan

Real-world example: An advisor generates a report showing a client’s investment returns versus their retirement goal benchmarks, highlighting gaps or opportunities for reallocation.

6. Secure client communication portal

Email is not secure enough for sharing sensitive client data. A secure portal gives clients peace of mind and reduces compliance risks for the advisor. It also keeps communication organized and tied to the right client.

While not all CRMs include a built-in client portal, many support secure file sharing through integrations. These tools help centralize sensitive communications and ensure client records stay complete and compliant.

Real-world example: A client uploads their 401(k) statements through the CRM’s portal instead of emailing them. The advisor reviews them and responds with a suggested rollover plan.

7. Integration with financial planning tools

Advisors often rely on financial planning software like eMoney or MoneyGuidePro. A CRM that connects to these tools saves time by eliminating double data entry. It also allows for a unified view of each client’s financial picture. Tools such as Alpha Spread can help advisors bring intrinsic value and relative valuation data directly into client conversations alongside CRM workflows.

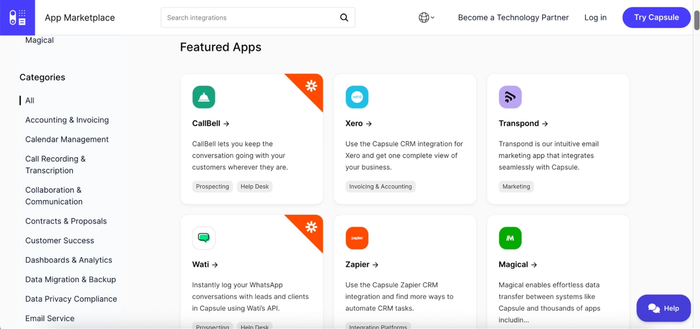

Capsule CRM connects with hundreds of tools via Zapier and has an open API, enabling advisors to integrate with portfolio and planning software.

You can explore a wide range of integrations for Capsule, both native and connected through Zapier.

Real-world example: An advisor pulls in real-time portfolio values from Orion into the CRM and uses it during a call to explain how the market has impacted the client’s allocations.

8. Compliance tracking and audit trails

Every recommendation and document must be recorded for regulatory purposes. Advisors need a reliable way to show what was discussed and when. An audit trail helps in case of a client dispute or firm-level review.

Every good CRM stores a full history of notes, emails, and file uploads for each client, making it easier to maintain a clear audit trail.

Real-world example: After making a portfolio change recommendation, the advisor logs a note and attaches a signed risk tolerance update form. This creates an auditable history in case of a future review.

9. Segmentation and tagging

Not all clients have the same needs. Tags and segments let advisors group clients by age, AUM, or goals for targeted communication and service. This helps advisors prioritize time and personalize outreach.

Most CRMs allow tagging contacts and creating filtered lists based on tags or custom fields for targeted messaging and follow-ups.

Real-world example: The advisor runs a filtered list of clients aged 55–65 with over $1M AUM to invite them to a retirement readiness webinar.

10. Mobile access and voice notes

Advisors meet clients outside the office and take calls while traveling. Without mobile access, they can forget or delay key updates. A CRM app with voice input helps capture details in real time.

Capsule CRM’s mobile app lets advisors record voice notes, update tasks, and review contact details on the go.

Real-world example: After a lunch meeting, the advisor records a voice note in the mobile CRM app summarizing the client’s intent to set up a trust. An assistant later uses the information to schedule a legal consultation.

Now that you know which features you need to nurture better client relationships and improve your document management, let's see how the top CRM options stack up against each other.

Conclusion

The right CRM lets you build stronger relationships and scale your service with less manual effort.

Whether you're a solo advisor looking for a simple system or a growing firm managing complex workflows, there’s a CRM on this list that fits your model.

Capsule is a great fit for advisors who want clarity and flexibility without spending months learning all the features.

Try it free and see how it helps improve client management, automate follow-ups, and keep your team focused on delivering value.

Frequently Asked Questions

A CRM in finance is a central software system that stores all client data and interactions in one place. It helps advisors track financial goals, automate reminders, and improve client communication efficiency.

Ask how intuitive the user experience is and if your team can learn it quickly, what integrations are available with your planning and portfolio tools, and whether compliance workflows are supported. Ideally, you should be able to try out a free plan or trial before committing to a paid plan.

Basic CRM plans typically start around $18 to $50 per user per month, with more advanced systems that include compliance support, analytics, or AI features ranging from $100 up to several hundred per user per month.